HUD Releases Mandatory Market Rent Threshold Test

🎧LISTEN

The Market Rent Team examine HUD's policy change requiring a mandatory market rent threshold test for Rent Comparability Studies or RCS.

Section 8 laws and procedures require the U. S. Department of Housing and Urban Development (HUD) to obtain and review Rent Comparability Studies (RCS) when renewing most Section 8 contracts. The market rents resulting from these studies determine the rents owners can receive under the program and greatly influence whether an owner will renew and continue providing affordable housing or opt-out of the Section 8 contract and convert to market rent housing. The market rents set in these studies also drive HUD’s outlays for Section 8 project-based subsidy.

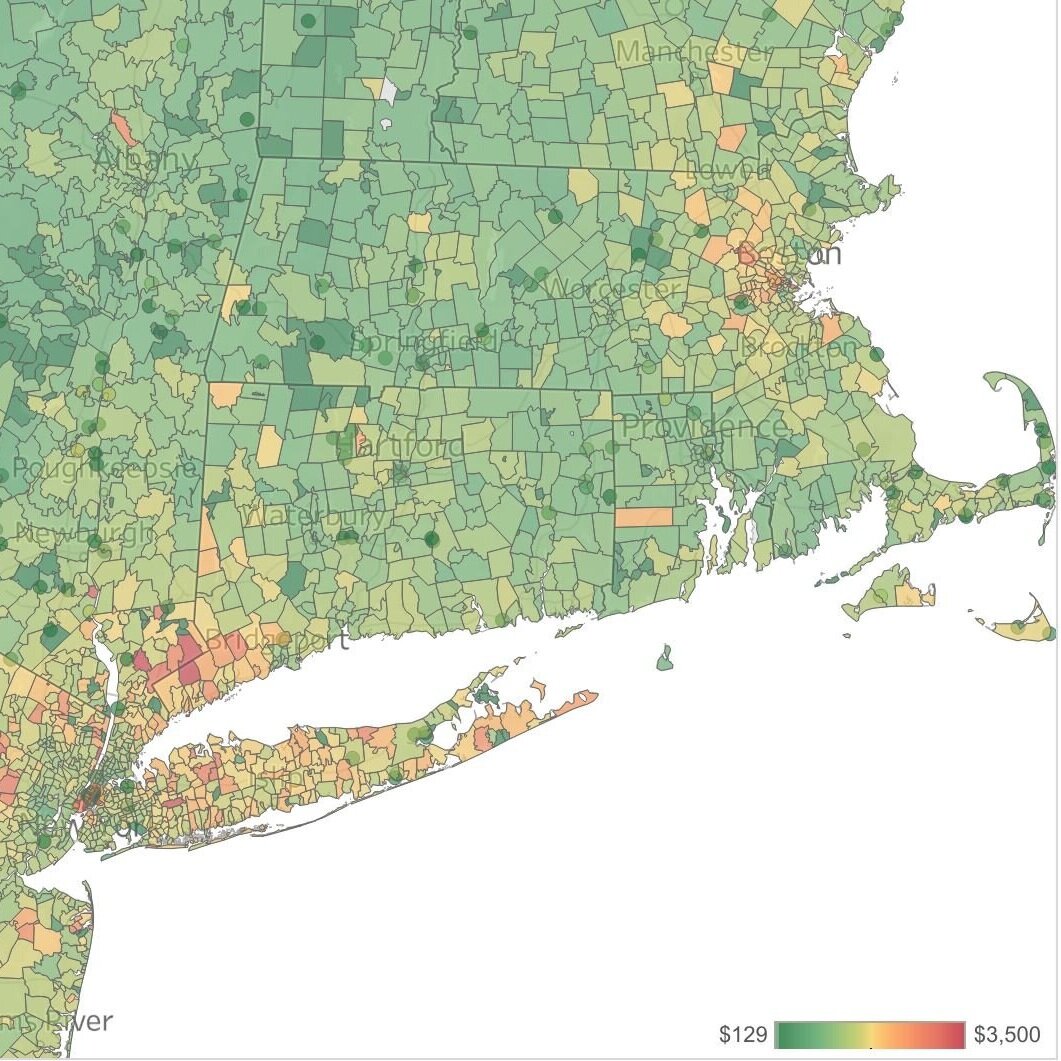

In August 2015, HUD issued a new Section 8 Renewal Policy Guide, which required a mandatory market rent threshold test. If the rents in the owner’s study exceed 140% of the median zip code where the subject property is located, then HUD would require a third-party RCS.

The mandatory market rent threshold test is a 3-step process:

Step 1: Compute the Subject Project’s median rent as determined by the RCS

Step 2: Identify the 140 percent Median Gross Rent for the Subject Project’s zip code

Step 3: Compare Project’s median rent to 140 percent of Median Gross Rent

“If the rents in the owner’s study exceed 140% of median zip code rent threshold, then HUD will require a third-party Rent Comparability Study (RCS).”

When the median gross market rent in a zip code equals or exceeds $2,000, the Census Bureau does not report the actual market rent value. Instead, the Bureau assigns such zip codes a value of “$2,000+” (or $2,800+ with the 140% escalation factor). If a Subject Project is located in a zip code where the Median Gross Rent is estimated at “$2,000+”, HUD will compare the owner’s gross potential rent with the current HAP contract rents.

If the gross potential is less than 140 percent of $2,000 (or $2,800), then no further action is required and the final comparable market rent is determined by the owner’s RCS; or

If the gross potential is greater than or equal to 140 percent of $2,000 (or $2,800), but less than 105 percent of the current HAP contract rent for the subject project, then the final comparable market rent is determined by the owner’s RCS; or

If the gross potential is greater than or equal to 140 percent of $2,000 (or $2,800), and greater than or equal to 105 percent of the current HAP contract rent for the subject project, then a HUD-commissioned RCS would be required.

When the Median Gross Rent Estimate is unavailable for a certain zip code, the U.S. Census Bureau reports the value as “missing” or “blank” (or “**” on the HUD published Median Gross Rent Excel spreadsheet). This may occur for zip codes that belong to national parks, resort areas, or in some rural areas so sparsely populated that there is an insufficient number of rental units available for the Census Bureau to compute and report a Median Gross Rent estimate. If the Subject Project is located in such a zip code, HUD will compare the owner’s gross potential rent with the current HAP contract rents.

If the gross potential is less than 105 percent of the current HAP contract rents, then no further action is required and the final comparable market rent is determined by the owner’s RCS; or

If the gross potential is greater than or equal to 105 percent of the current HAP contract rents, then a HUD-commissioned RCS would be required.

HUD published the new median zip code rents and the 140% thresholds - these numbers will be effective for any RCS signed by the owner’s appraiser on or after February 11, 2016.